Strengthening Motorcycle Insurance Integrity in Malaysia with RideHawk™

Why This Matters

- 16.77 million motorcycles out of Malaysia’s 36.3 million registered vehicles.

- 75.3% of road deaths in 2023 involved motorcyclists.

- New Policy Shift: The Ministry of Human Resources will roll out the Non-Occupational Accident Scheme (SKBBK) in 2025, offering 24-hour protection beyond working hours.

This expansion is good for workers — but it also increases claims volume and creates new opportunities for fraud.

Protecting Motor Bike Riders

The primary function of RideHawk is to help prevent accidents. And any accident prevented is good news for everyone involved as money is saved, paperwork avoided and most importantly injuries avoided.

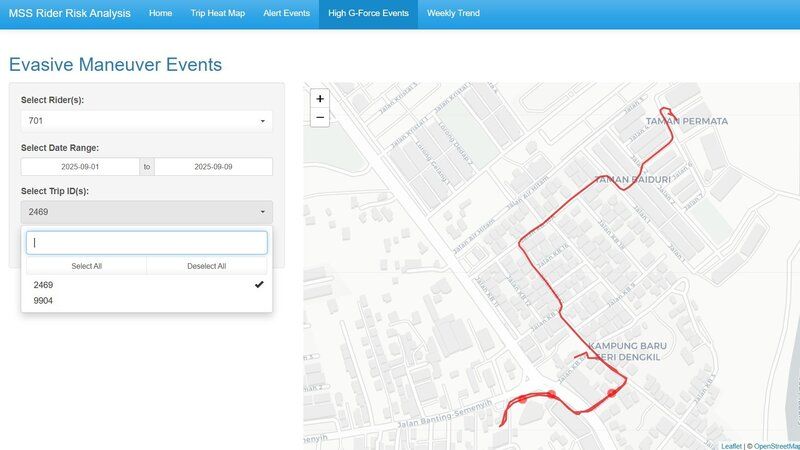

However, using RideHawk’s data in case of an accident can help prevent fraud as the information gathered during each trip gives a detailed account of where a rider was driving and how s/he behaved. Ultimately, the goal is to prevent accidents, however, in case of any incident, RideHawk’s technology can be called upon to ensure compliance.

The Fraud Challenge

Motorcycle insurance fraud drains insurer resources and raises premiums for honest riders. Common schemes include:

- Misreported commutes (accidents outside commuting hours falsely reported as work-related to qualify for coverage)

- Staged crashes (deliberate falls claimed as major accidents)

- Exaggerated damages (minor scrapes reported as collisions)

- Duplicate claims (same accident filed across policies)

- Phantom passengers (adding non-existent riders to inflate payouts)

- With SKBBK in place, insurers need stronger, faster verification.

How RideHawk Helps

RideHawk is a motorcycle black box — capturing GPS routes, speed, braking, and crash-impact signatures.

- Verify claims objectively with timestamped ride data

- Detect fraud quickly (misreported, staged, duplicate, or exaggerated claims)

- Settle genuine claims faster for honest riders

- Enable fairer pricing with usage-based insurance (UBI)

- Align with SKBBK by protecting workers while closing fraud loopholes

- Speed-up processes by offering the ability to positively verifying location of accident site

Next Steps for Insurers & Employers

- Pilot RideHawk with high-risk groups like delivery riders.

- Work with regulators to recognize telematics as admissible claim evidence.

- Adopt RideHawk under SKBBK to protect employees and reduce fraud exposure.

- Educate riders on how safer driving leads to fairer premiums.

Conclusion

Malaysia is entering a new era of worker protection with SKBBK. To make it sustainable, insurers and employers need tools that protect against fraud without slowing down genuine claims.

RideHawk provides the solution: transparent, data-driven protection for riders, insurers, and Malaysia’s road safety future.

Ride Smart. Protect Workers. Safeguard the System with RideHawk.